Surveying the State of the UAE’s Increasingly Diverse & Dynamic Independent Wealth Management Market

An insightful survey by #Hubbis on the State of the UAE’s Increasingly Diverse & Dynamic Independent Wealth Management Market.

The report indicates that independent wealth management has a great deal of growth potential and could soon eat into the private bank market share. In order for UAE-based independent wealth management to surpass their Asian and European counterparts, there is still much work to be done in the areas of Trust, People, Platform and Clients.

At BMC we offer Consulting services for the Wealth Management industry to be future ready, supported with cutting edge technology for enhancing RM Productivity, straight-through processing, amongst many other technology improvements. Reach out to us at hello@belginjava to know more.

#technology #wealthmanagement #people #future #consulting #eam #advisory # #productivity

The independent wealth management sector – including external asset managers (EAM) and Multi-Family Offices (MFO) is growing apace, and with the rapid progress, expansion and liberalisation taking place in the Middle East, many now believe that there are huge opportunities ahead in the UAE’s wealth market, where growth in recent years has been significant, albeit from a rather more modest base.

Moreover, set against the truly dramatic (and continuing) expansion of HNW and UHNW private wealth in the region and also by the powerful wave of new HNW and UHNW clients and families working through or even moving to the region – the EAM sector has much more potential, and there is plenty of room for growth amongst existing players and plentiful room for greater diversity with the arrival of new entrants.

The inaugural Hubbis Independent Wealth Management Forum will take place on March 15, and in anticipation of that event, we have conducted a short survey as a ‘taster’ on the evolution of the market and the key challenges ahead.

It is clear from the replies we received that in order to survive and prosper, the incumbent independent players, and the future competitors, must all set themselves a very clear differentiation strategy.

They must align their cultures and their talent to their clients and focus on their quality, their objectivity, and their trustworthiness.

They must offer not only sound, impartial, wide-ranging investment expertise, but they also need to present a holistic offering that includes a broad range of advice to encompass the real-world needs of their clients, and indeed their families and future generations, including around estate and legacy planning.

They should work closely and collaboratively with the digital platform providers and private banks, the latter of which incidentally need to boost their support of and focus on the EAM/MFO segment. Additionally, they should optimise digital connectivity and solutions.

And many of the replies we received indicated that while the regulators have been doing a good job overall in recent years, the independents need further specific and dynamic support from the regulators to help propel them along their journeys.

What was emphatically clear from the replies is that the growth ahead will very probably be substantial, with 58% of respondents predicting annual growth of more than 25% over the coming five years. It is of little surprise then that the existing players are striving to up their game, and there are plenty of new entrants, mostly from other international wealth management jurisdictions such as Switzerland, Singapore and Hong Kong.

In short, plenty of excitement and many challenges lie ahead. Read on…

The Key Findings, Insights & Observations

Setting the scene: significant progress already, but plenty more can and must be achieved

Private wealth in the UAE and the wider Middle East is being minted at incredible speed, and more and more locals are joining the ranks of the HNW and UHNW community, while many more are moving to the growing ranks of mass affluent as the region’s economies diversify and expand, amidst liberalisation and support from the governments and authorities. At the same time, suddenly the UAE is truly on the map as a base for HNW and UHNW individuals and families to reside in, and the governments are seemingly doing all they can to draw in more of such wealth and immigration to the region.

An area of significant potential is the family office space, where respondents report very rapid expansion in the UAE, driven by the internationalisation and liberalisation of the region and very supportive authorities and indeed governments.

To cater to these rapidly expanding ranks of could-be clients and their increasing needs, expectations and diversity of investments and structures, the region’s independent wealth management (EAM) firms – both the incumbents and the new entrants – need to first define and then continuously hone and refine their strategies in order to seize those opportunities.

As they do so, the EAM sector can gradually emulate the significant – but still for many also somewhat disappointing – progress of their peers in Asia, where the key players have of course seen the success of Switzerland and other European markets in terms of the penetration of the independent wealth providers.

There is little doubt that the EAM market in the UAE is a land of opportunity. However, can the existing players and the new entrants who are coming in quite thick and fast adopt the right models to win more market share of the rapidly expanding private clients AUM in the region and claim the clients from the banks, and the global and boutique international private banks?

How can the independents scale up sufficiently through technology, for example not only adding cost-saving solutions and RM-boosting technology, but also by embracing external investment and custody platforms and bringing in new talent and even new offerings to compete in the markets of tomorrow? And can they also future proof their businesses and extend their relationships beyond their founder/creator type clients – both the locals and the internationals – to the younger generations, some of whom are making new wealth and others of whom are inheriting or set to inherit vast wealth?

The Market Outlook

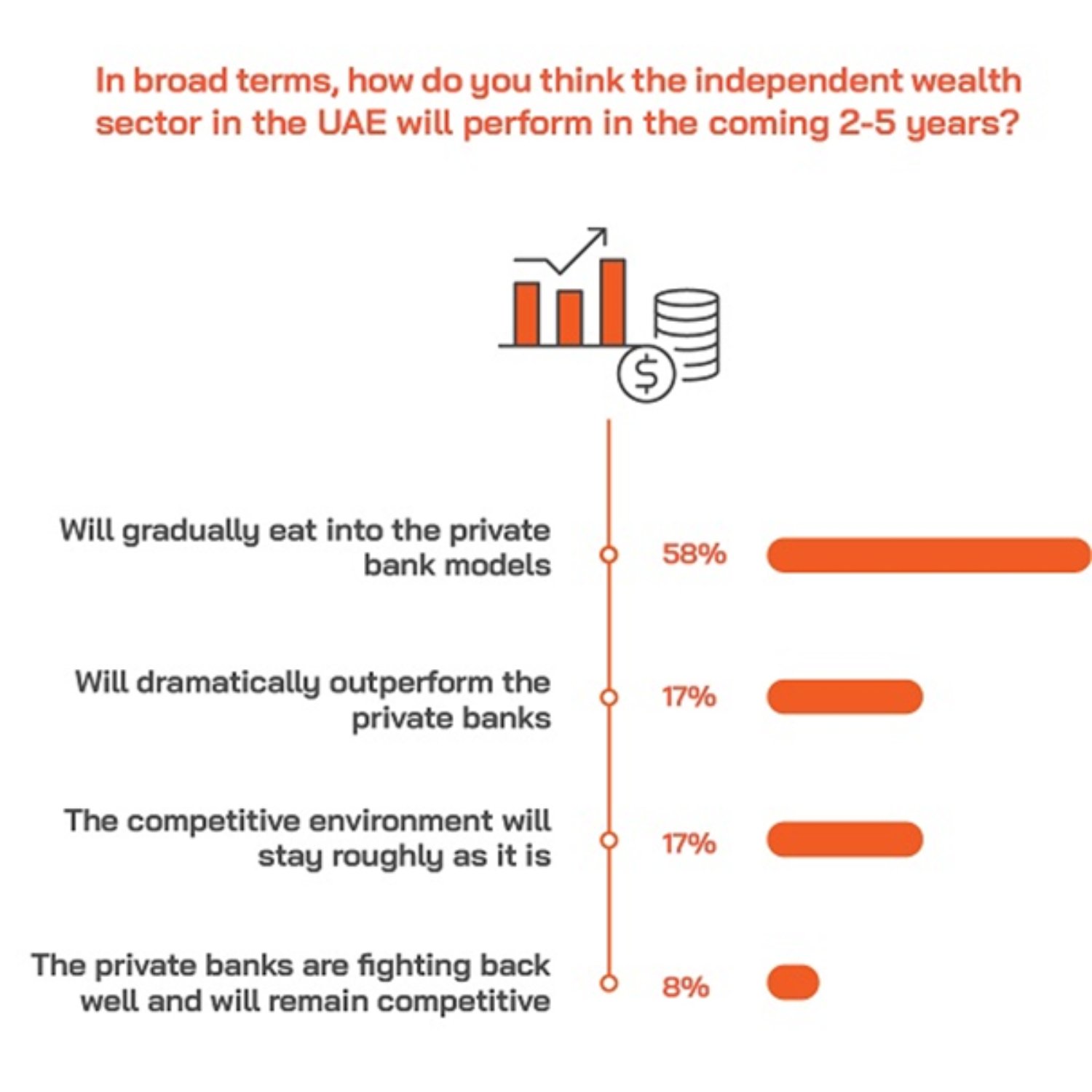

75%of replies indicated that the independent wealth management sector in the UAE will eat into the dominance of the private banks in the foreseeable 2-5 years, with 17% of respondents optimistically reporting that the EAMs will dramatically outperform the bank offerings.

Only25%predicted that the private banks will retain or even improve their current competitive position

58%of replies were remarkably positive about growth prospects for the independent wealth management sector in the UAE, stating that they expect the segment’s AUM growth to register at least 15% yearly during the coming five years, with more than half of those respondents bullish enough to predict growth rates in excess of 25% per annum, which is remarkably optimistic.

Meanwhile91%forecast growth of at least 10% annually.

And only8%predicted that the market – as represented by total AUM for the independents – will grow at rates of just 5% or less.

Meanwhile it was nearly a50/50tie when we asked if the regulators are playing their part fully in supporting the independent wealth management market, with some respondents reporting separately that the regulators are doing far more than they had expected, and others – mainly those coming in from other international jurisdictions – calling for more proactive and innovative support.

The EAM sector in the UAE is relatively young, and not yet fully punching in its potential weight class; more differentiation is required and more talent

The EAM sector could be growing faster. One shortfall survey that respondents highlighted is the lack of the right strategies towards differentiation, and the absence of the critical edge. This is tied up to some considerable extent by the shortage of talent, as the market is not that deep and there is also a shortage of RMs and advisors who are willing to become more entrepreneurial risk-takers, rather than sticking to the relative safety of the banks’ and private banks’ well-furnished halls.

Another key area requiring improvement is the possible lack of transparency. There is a strong suggestion the independents are pricing their services and their offerings to high, and not being especially open about retrocessions and trailer fees as well.

Part and parcel of making the fee structures more appealing to clients but also then improving profitability in the medium-term will be the tough balancing act of expanding the client base, outsourcing more to the digital platforms and private banks, enhancing digital solutions around efficiency and client centricity, and diversifying the range of services from product-driven investment management to more discretionary offerings and to estate and legacy planning and structuring.

Being transparent, objective, and client-centric are all vital qualities for EAMs

Survey respondents pointed to the corrosive potential of trailer fees if those are not clearly explained to clients, whilst others called for greater transparency. If the independent wealth model is to fulfil its potential, retrocessions can endure if permitted by the regulators, but clients will become increasingly wary if they are not advised about them clearly and openly in advance. After all, retrocessions still exist in the Singapore and Hong Kong markets, but there we have seen a major thrust towards proactive disclosure.

As yet, the idea of a regulatory-driven Australian model – it has transitioned from commission-based or retrocession-based advice into the fee for service model – is not even under consideration. Accordingly, the half-way house model will work best – in other words trailer fees can still be earned but the key is transparency around them and potentially giving clients the option to choose how they pay for the service that they receive; that could be purely advisory fees, or commission based, or a mix of the two. In other words, roll with the existing regulations, but temper and improve practices so that the client is properly informed and understand what they are paying and why, both directly and indirectly.

Trust is critical to the evolution of the EAM market, and trust will help improve the visibility and predictability of revenues

As the market evolves, it is likely that there will be a greater thrust towards advisory and even discretionary mandates. And guess what? Those EAMs and MFOs that win and retain the trust of their clients – not just around investments but also around more holistic estate and wealth advice – are more likely to succeed in this transition. Asia’s private banking and independent wealth management competitors have been striving towards a more recurrent business model, and whilst it is not easy and it lags well behind the Swiss model, progress has been made. Respondents reported that the UAE’s independent wealth sector will almost inevitably follow the same path, albeit from an even lower starting point.

Key Characteristics Required

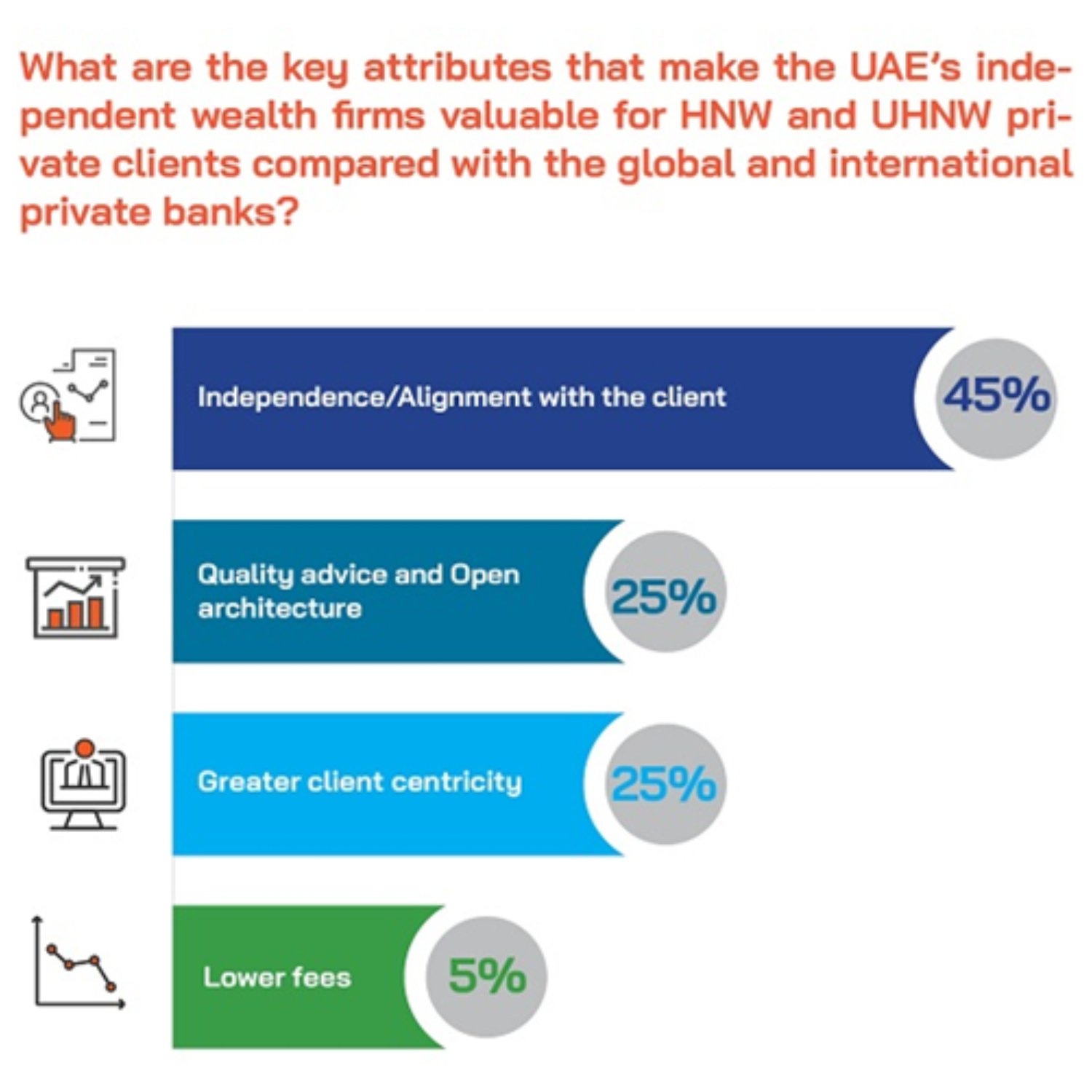

95%of replies indicated that it is the key qualities of independence, alignment with clients, sound advice, open architecture and overall greater client centricity that will drive the independent wealth sector forward in the UAE’s increasingly dynamic private wealth markets.

Only5%of respondents think that lower fees will win more clients; in other words it is the qualities of differentiation from the mainstream providers such as the private banks or the wealth arms of the major local and regional banks that will make the critical difference in the years ahead.

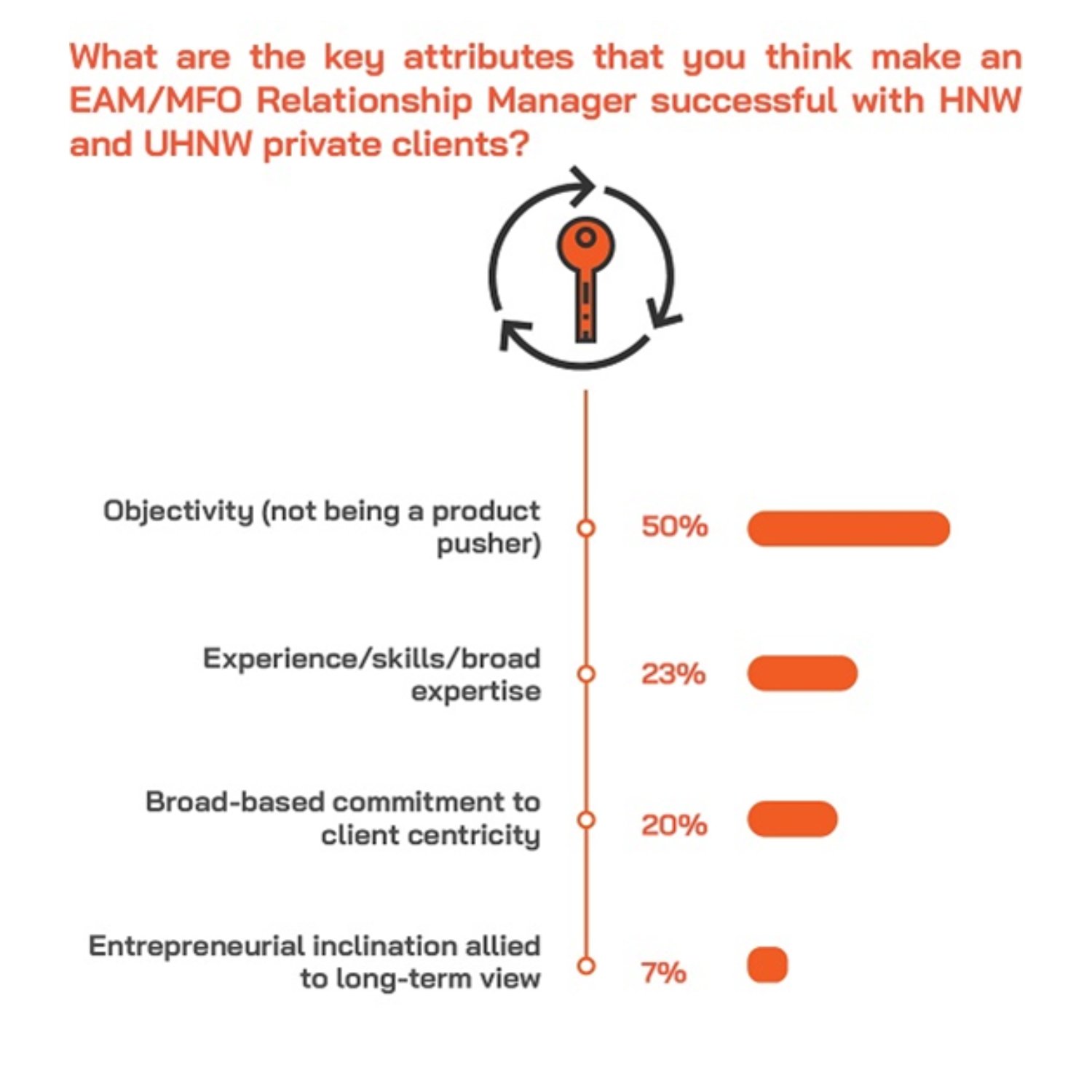

93%of those surveyed believe that the RMs and Advisors at the EAMs/MFOs will be successful if they bring a powerful combination of experience, skills, objectivity and client centricity to the table.

50%of replies indicated that a critical virtue for such independent private client specialists will be their lack of product-pushing, with some respondents remarking separately that this is potentially an ‘Achilles heel’ for the private banks that have long plied their trade in the region with little genuine competition.

Interestingly only7%thought that entrepreneurial flair is a defining attribute for these advisors, implying that

Intra-regional and global expertise and connectivity are vital elements in the independent offering

A lone independent firm can survive in the UAE, such is the overall growth momentum, but they will not prosper as they should if their principals and key advisors do not have connectivity to and expertise around other regions of the globe.

Such relationships, partnerships and expertise should not only by focused on investments, but also around an awareness of key structuring estate and legacy advances, of key structures, regulations, basic tax issues, geopolitics, investment migration, key emerging trends, and so forth.

On the investment front, access to public assets and markets of all types are of course essential, but so too is connectivity for deal-flows to originators or distributors of private funds and private market opportunities, especially as wealthy private clients expand their allocations away from the mainstream tradeable assets and indeed as the stock of listed opportunities continues to diminish over time, as has been happening for the past several decades, in favour of less liquid and longer-term investments.

It is important to invest wisely and efficiently in diversifying business models towards digital delivery and more advanced digital solutions while retaining the personal connectivity and a more individualised culture and approach

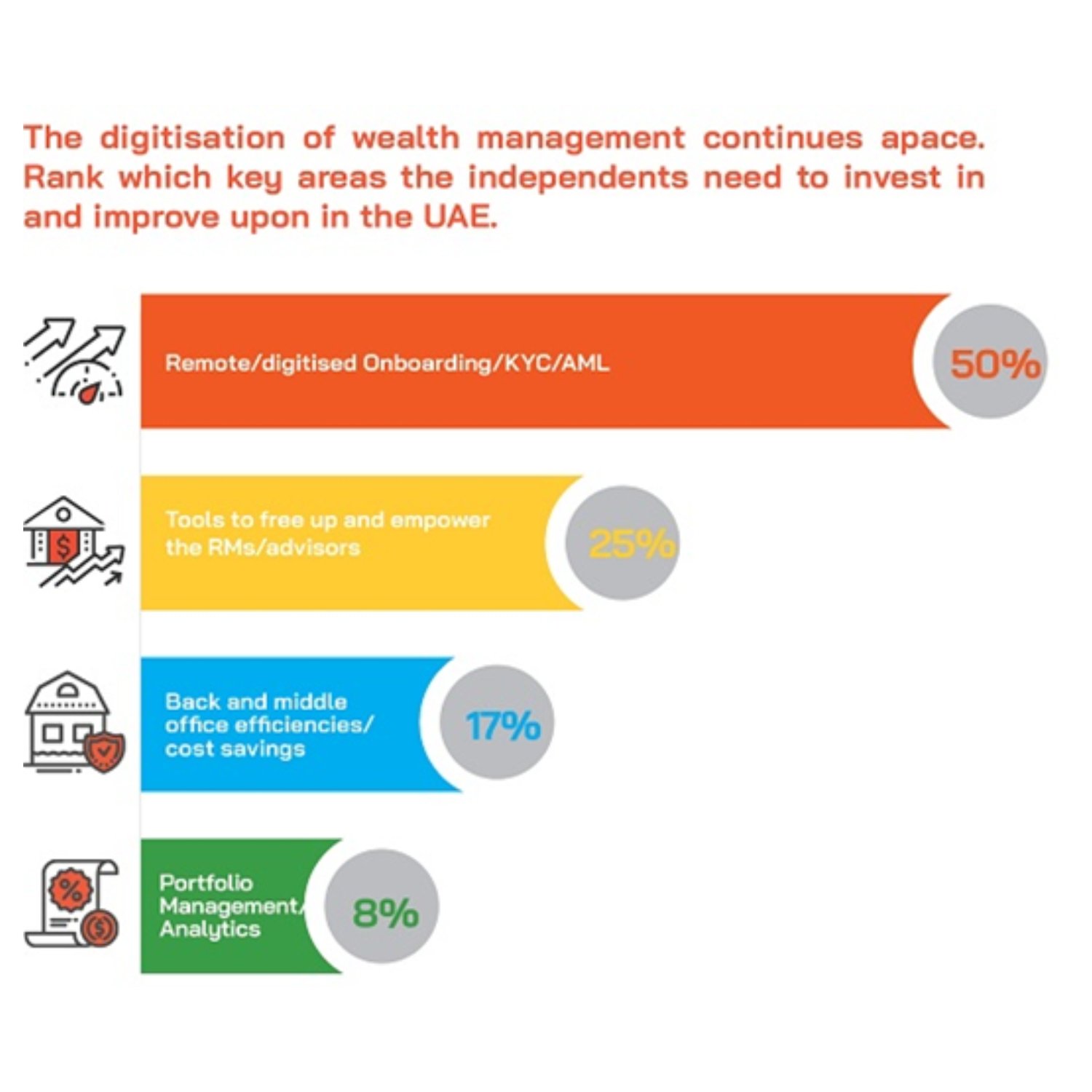

None of the replies we received to our short survey advocated the robo advisory type model for the growing EAM sector in the UAE. But there was a clear indication that the independents should be investing wisely in the right digital technologies to boost efficiency and to enhance the client experience, from onboarding and KYC to easily accessible data and reporting.

Meanwhile, the right investments – and also outsourcing – will help streamline administrative costs and productivity, whilst investment targeted at the RMs and advisors will help eliminate some mundane tasks, improve job satisfaction, enhance personation and relevance for the clients, and all that will help drive AUM retention and growth.

The right types of products, alongside digitised execution and robust custody are all immensely valuable in helping to boost the EAM proposition

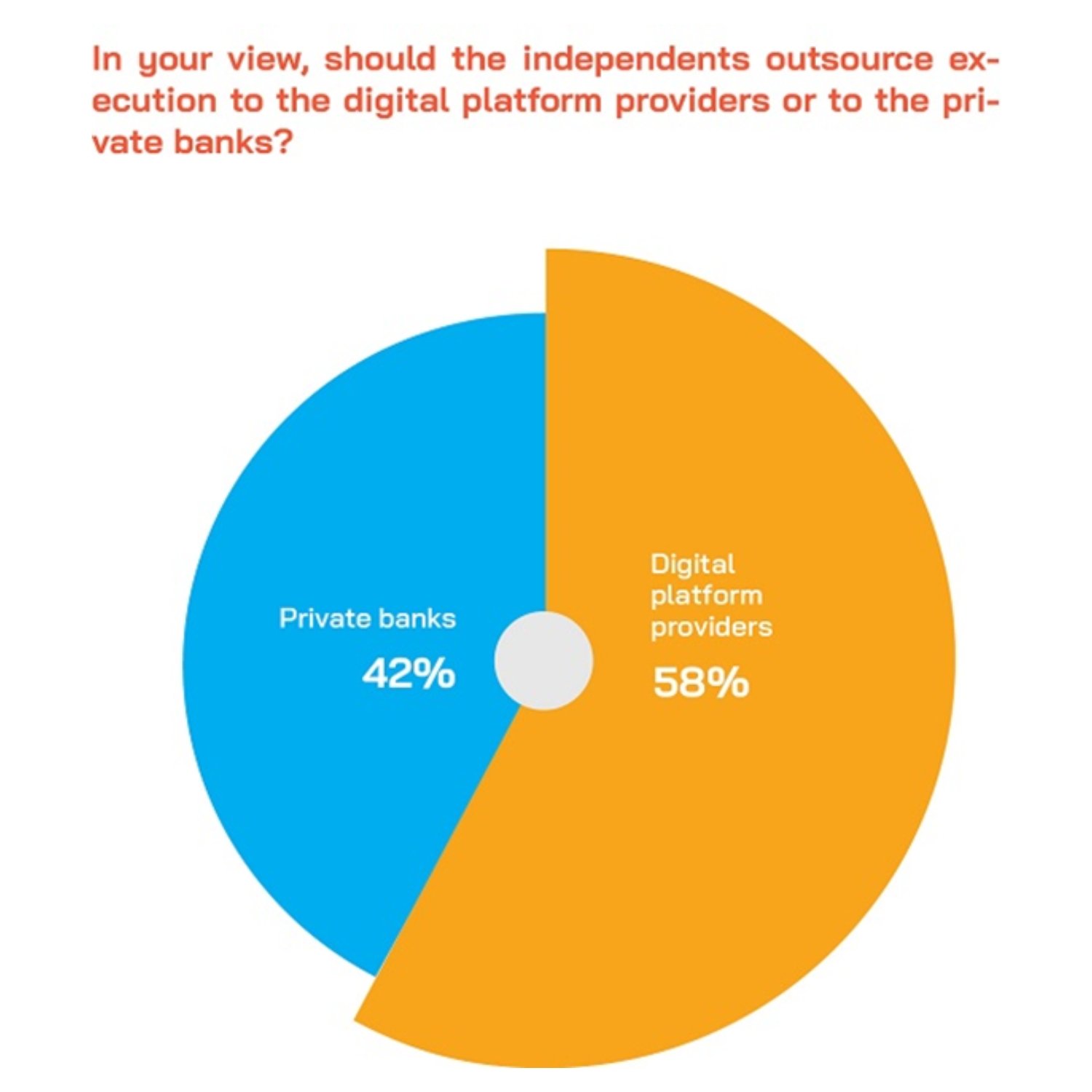

No independent firm can survive alone as an island. To be fully in the stream of idea and product generation and flows, to deliver clients the right execution capabilities and also optimal custody solutions, the EAMs and MFOs should be working both with the private banks and the digital platforms.

In this regard, respondents remarked on the rising marketing efforts and associated brand recognition amongst the digital platforms, but they also noted that to attract often highly conservative wealth clients to their independent offerings, they should also deliver the additional solidity and support of custody solutions from the bank community.

It is true that many clients today and many in the independent space these days do not place as much importance on being a client of a private bank. It is also true that what they really care about is what kind of offerings they get, and they see that digitised investment platforms have a wide array of advantages. But it is also a reality that Middle Eastern clients are conservative by nature and still like to sense of security that the private banks bring in their own execution and also custody offerings.

Additionally, the EAMs all appear to anticipate very strong growth ahead, meaning that they need to really scale their businesses, and to do so without massive and prohibitive investment themselves, they need to deliver the best service and outcomes through outsourced custody and execution partners. The EAMs can thereby focus their efforts on the human touch, on the actual advisory and do not need to allocate too many resources and time to just make sure that the operational issues are sorted properly.

However, our respondents also highlighted how the private banks are not yet active and energetic enough in building their EAM business and desks in the UAE, unlike in Asia, where the banks have seen that they should be working with the EAMs and not simply closing off in some sort of denial of the competitive realities.

Whatever the mentality of the private banks today, there are alternatives in the digital platforms, and most certainly, it is critical for the EAM community to build its advisory and services partnership ecosystem in order to deliver best-of-breed advice and solutions.

Steering the Right Course

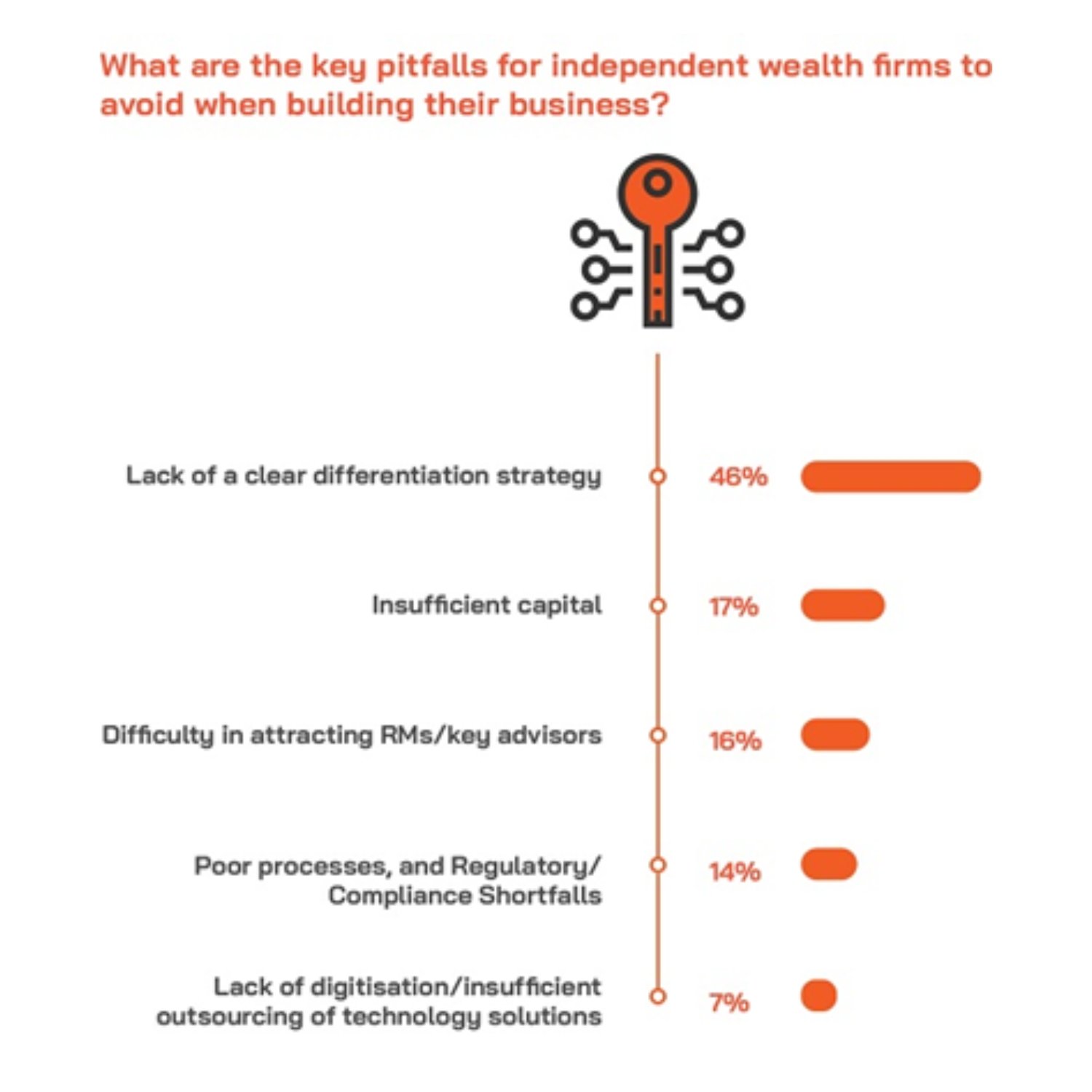

46%of replies called for better and more decisive differentiation strategies for the incumbent EAMs and those establishing new operations in the UAE

And only16%of respondents – a surprisingly low number – indicated that lack of talent is a major impediment to growth, which is somewhat encouraging for their ability to realise the future growth potential that so clearly lies ahead.

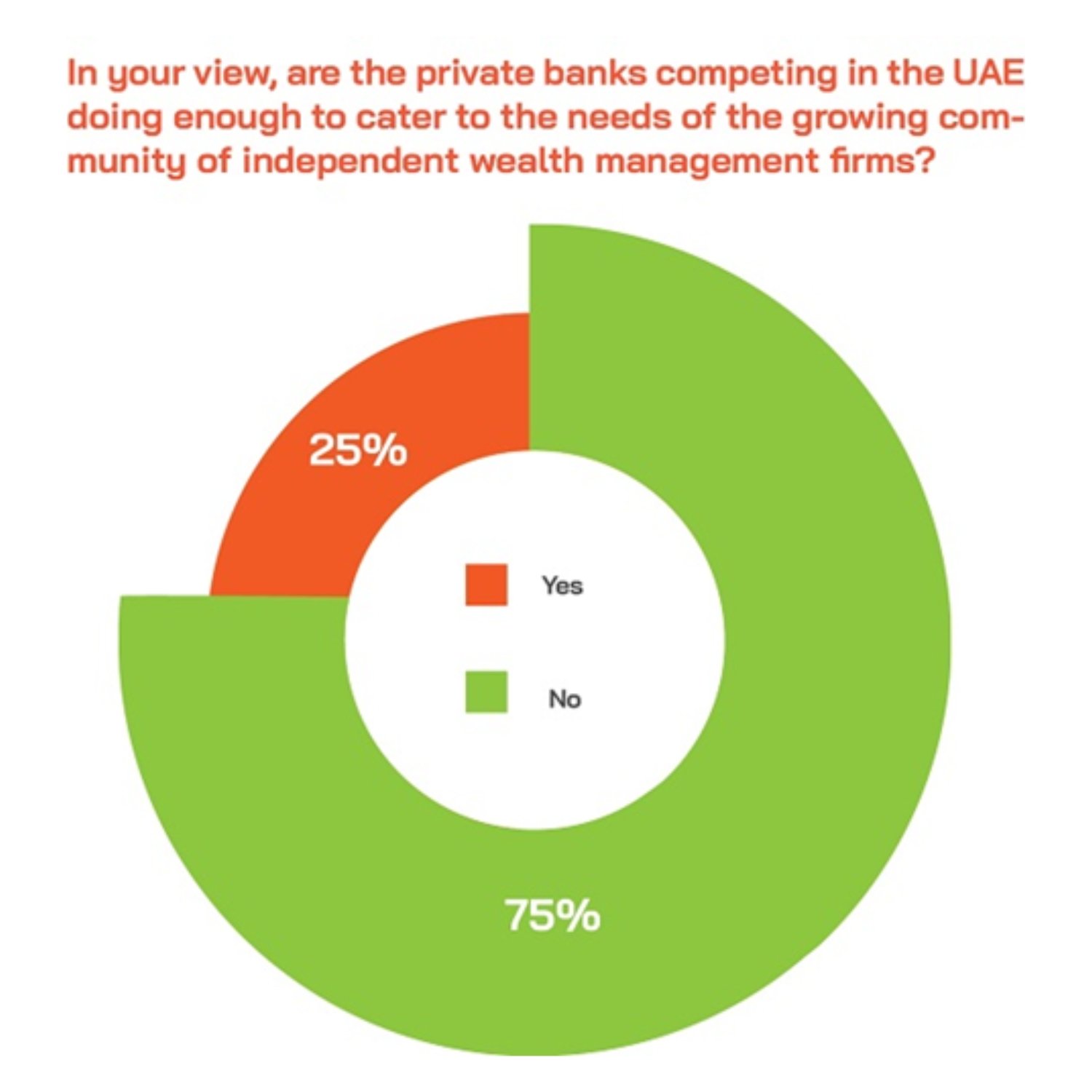

A striking 75% of replies stated that the private banks should be doing considerably more for and with the growing EAM community in the UAE, as well as doing it all significantly better.

A striking 75% of replies stated that the private banks should be doing considerably more for and with the growing EAM community in the UAE, as well as doing it all significantly better.

Estate & Succession planning and advisory should also be on the menu for EAMs seeking to offer a more holistic wealth management proposition

It is well acknowledged that estate, succession and legacy planning and solutions are of increasing importance to all clients in the UAE as the region’s founder generations age, as the younger generations return from overseas armed with their Western educations and perspectives, and as more global HNW/UHNW individuals and indeed families flood in and need a wide range of advice and support.

The UAE has been working hard to position itself as a wealth managing centre. And some might argue it’s becoming increasingly appealing to many – including the significant ranks of wealthy Indian Families.

Accordingly, for independent wealth management to thrive in the Middle East, there is no doubt that the quality of advice on wealth structuring, and estate planning must continue to improve. It is happening but thus far less so in the independent segment, which has far fewer financial or personnel resources than amongst the banks. However, there is a growing emphasis on a more holistic wealth offering, and on greater diversity of expertise and professionalism.

The UAE is taking all necessary steps to position itself as a wealth management centre. It is creating necessary framework in terms of regulations and infrastructure to support these estate and legacy structuring needs.

There are many structuring options today in the UAE and the increasing range of choice is spurring greater competition – so the EAMs need to stand up and be counted

The range of options has expanded, so for example anyone wanting to establish a single-family office could think seriously about realistic and robust alternatives in the Dubai International Financial Centre (DIFC), or the Abu Dhabi Global Market (ADGM). The DIFC has got its own codified laws, while the ADGM is in strict compliance with English law.

There is also a lighter touch option available to those who want a slightly more informal but well-incorporated environment in which to manage and make investments for families is the DMCC. The Dubai Multi Commodities Centre (DMCC) was established as a free zone in 2002 by the Government of Dubai to provide the physical, market and financial infrastructure required to establish a hub for global commodities trade. And DMCC today has a SFO offering that aims to be as competitive as possible.

And another new entrant is the Dubai World Trade Centre Free Zone, which now offers not only a single-family office option, but also that of the first in the region a multifamily office option as well.

All these developments are reflective of the thriving and optimistic wealth management market, and the increasing global wealth in terms of private family-owned wealth. There is rising competition locally to provide the best options. And the speed of progress is helped by the openness of the government to work and other visas for experts from around the world.

There are many advantages and appeals of going independent, but the leaders, RMs and advisors must at heart be entrepreneurial, client-centric and also rather patient

The EAM model is all about developing different and deeper relationships with the clients, and truly working for them. For the RMs and advisors in the EAM business already or thinking about moving to the independents, this requires a rather different mindset from working at a major local, regional or indeed global financial institution.

But at the same time, the replies we received indicated that there is not yet sufficient aversion to the product-pushing approach the private banks are often accused of. In other words, the objectivity and absolute client-centricity required of EAMs who want to grow apace are still somewhat lacking. In short, if you are independent or plan to go independent, you need to change your mindset, and to really work for the clients.

Additionally, you will need patience, so it is vital not to underestimate the hurdles of building the right infrastructure or creating the network and extending the relationships. Although the potential is huge, it will take time for the EAM business to gain traction and then build momentum. This is a long-term business, and if you build the relationships and deliver on your promises, the rewards will follow.

Selected observations from the Market